Q2 2025 Research Theme: Can Canada Become An ‘Energy Superpower’?

- Jun 29, 2025

- 17 min read

Updated: Aug 20, 2025

In years to come, Canadian citizens may thank President Trump for his draconian tariff-driven blows to Canada’s collective solar plexus, and his routine belittling of Canada and, albeit unpopular, ex-Prime Minister Trudeau.

Certainly, Canada’s Liberal Party should be grateful for the stunning turnaround in its fortunes, given the 25-point lead that the Conservatives held at the turn of the year. Trump’s swingeing import tariffs and bombastic threats to annex Canada saw the Liberal Party led by Mark Carney, a brand-new and politically untested leader, seize and ride a wave of resurgent Canadian nationalism to a fourth consecutive election win, Conservative leader Poilievre losing his seat.

Stealing a march from more seasoned political opponents, Carney adroitly used Trump’s threats to Canada’s economy and sovereignty as a clarion call for national unity but there remain deep-seated divisions across Canada that will no doubt challenge his minority government - which lies three seats short of a full parliamentary majority.

Unsurprisingly, the Liberal Party remains effectively shut out of Alberta and Saskatchewan - Canada’s primary oil & gas provinces - which have long felt alienated from central government in Ottawa, due in large part to the federal imposition of myriad Trudeau-era environmental policies and regulations.

Never Let A Good Crisis Go To Waste’ - And Move Swiftly Since All Political Mandates Have An Expiry Date

In his victory speech, Carney clearly heeded advice long attributed to Winston Churchill: ‘Never let a good crisis go to waste’, issuing a Churchillian ‘call to arms’:

‘... the coming days and months will be challenging, and they will call for some sacrifices … we will need to think big and act bigger. We will need to do things previously thought impossible at speeds we haven’t seen in generations.’

Rousing prose, that’s for sure. But where’s the meat?

‘It’s time to build Canada into an energy superpower in both clean and conventional energy’

Of the various ‘national priority’ initiatives that he highlighted, we naturally focus on this ambition to transform Canada into an energy superpower: the opportunities that such an endeavour could ultimately deliver to Canadian upstream and midstream operators, oilfield technology and service providers and thus Canada’s overall economy, and the many long-standing political, social and environmental obstacles that will no doubt confront such an audacious ambition.

But, before we go any further, perhaps a good question to ask would be:

What does it take to be an energy superpower?

Definitions will no doubt vary but, beyond the obvious prerequisites: vast, world-scale resources and production capacity, an energy superpower must surely possess sufficient export (and domestic) infrastructure and trading capability to shape global energy markets: (i.e. influence global prices and underpin global supply security).

Canada is clearly not an energy superpower … yet.

Sure, Canada has the necessary scale of oil & gas resources and production. But Canada’s conspicuous reliance on the US for its oil & gas exports (and imports) jeopardises its own energy and economic security (not a good start for a wannabe energy superpower!). And, due to years of underinvestment, Canada lacks sufficient alternate export infrastructure to fully exploit its resources. This paucity of non-US energy exports not only stymies Canada’s ability to play a ‘superpower’ role in global energy markets but vastly diminishes the potential value of its rich energy resources.

Let’s do a ’pulse check’ - what is the current status of Canada’s oil & gas sector?

Canada Certainly Possesses World-Scale Energy Resources and Production …

Substantial oil and gas reserves and resources underpin Carney’s ambition for Canada to be an energy superpower. Oil Reserves: At 170 billion barrels (bnbbls), of which ~97% lie within Alberta’s oil sands, Canada holds the third largest proved oil reserves globally, well beyond the EIA’s 2023 estimates of 43 bnbbls for the US’ Lower 48 states.

Gas Reserves: Canada ranks ninth globally for proved gas reserves. Alberta alone holds more than 130 trillion cubic feet (tcf) of proved gas reserves, similar to the EIA’s 2023 estimate of 149 tcf for Texas.

Beyond proven reserves, Canada possesses a vast array of untapped oil and gas resources, ranging from the oil sands and shale plays to conventional discoveries in the North West Territories and offshore Canada’s east coast. Oil Production: Canada is the 4th largest producer of crude oil & condensate worldwide. Gas Production: Canada is the 5th largest producer of gas worldwide.

Canada’s dominant position in energy resources extends to uranium, hydropower and critical minerals:

Canada is the second-largest producer of uranium globally, in a market now dominated by Kazakhstan.

Canada is the third-largest source of hydroelectricity globally, behind China and Brazil

Canada holds a leading Top 5 or Top 10 global position in the reserves and production of many critical minerals such as cobalt, palladium, nickel, lithium and graphite.

… But Oil & Gas Exports Remain Unduly Dependent Upon US Demand & Transit Routes

As previously discussed in our year-end 2024 letter, Canada has long relied on the US as the sole export market or transit route for its crude oil and gas, creating a significant economic vulnerability. Furthermore, Canada’s eastern provinces depend on the US for most of their crude oil and refined product imports.

Some 450,000 kilometers of oil & gas pipelines link the Canadian and US energy markets - the result being the world’s most integrated energy market.

In 2024, 93% of Canada’s crude oil exports - 4.1 mmbopd - were shipped to the US, Canada’s only major non-US export route for crude oil being the recently expanded Trans Mountain (TMX) pipeline - capacity: 890,000 bopd.

The US has long been Canada’s sole gas export market, ca. 8.8 bcf/d meeting 99% of US gas import needs.

However, the June 2025 advent of export cargoes from LNG Canada’s facility in Kitimat, British Columbia (initial capacity: 14 mmtpa or 1.8 bcf/d) marks an important albeit modest diversification toward non-US gas markets.

Such dependence on the US market and transit routes for virtually all its oil & gas exports has cost the nation dear. Significant upstream, midstream and tax revenues have been sacrificed due to endemic underinvestment in domestic and non-US export infrastructure. Near-term, such underinvestment prompts regional bottlenecks, unwarranted price discounts and excessive price volatility. But the longer-term outcome has been restricted upstream production growth and meagre access to global export markets and better pricing.

TMX and LNG Canada Add Welcome Non-US Export Capacity, But Long Overdue and Way Over Budget

Years late and billions of dollars over budget, two vital oil & gas midstream projects - expansion of the Trans Mountain pipeline (TMX) and the LNG Canada export facility - came onstream in May 2024 and June 2025 respectively.

TMX Pipeline Expansion

Since TMX commercial operations began in May 2024, increased Pacific access has seen Canadian non-US crude oil exports more than double to 270 kbopd on average. Average crude oil exports to the US West Coast (PADD 5) - via TMX - are also up over 40% y-o-y to ca. 420 kbopd, although overall export volumes to the US remain flat y-o-y. Since the onset of TMX, and despite obvious head-to-head competition with cheap Russian crude, China has become Canada’s second largest and fastest-growing new crude export market. Indeed, recent While House tariff-led pressure on both China and India to cease buying Russian crude may, if enacted, prompt further demand for Canadian crude.

Canadian Crude Oil: Non-US Exports via TMX pipeline Y-o-Y Change in US Exports by US PADD Region (%)

Sources: Statistics Canada, US EIA

Canada’s heavier, sour WCS benchmark crude oil certainly warrants a quality discount relative to the US’ light, sweet WTI benchmark crude. Transit to its primary US market adds further transport-related costs.

However, beyond such quality and transport-related discounts, the over-reliance on the US market exposes such exports to the vagaries of US seasonal demand swings and further pipeline bottlenecks - and no doubt US customers’ strong negotiating position - the result being a wider and far more volatile WCS-WTI differential.

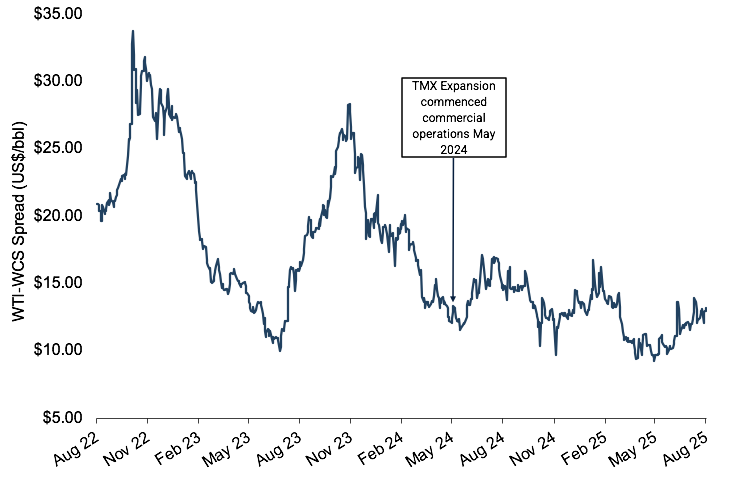

WCS-WTI Spread - Lower And Less Volatile

The presence of the 890,000 bopd TMX pipeline has introduced some long overdue competitive demand for Canada’s WCS benchmark crude. Although we have little more than one year’s worth of data, the average WCS-WTI price differential appears to have narrowed by about US$5-8 per barrel, accompanied by far lower seasonal volatility.

Furthermore, this improvement in WCS pricing has not impacted overall US export volumes which remain flat on a 12-month rolling basis - largely because 75% of US demand for WCS (PADDs 2 and 4) is largely inelastic - landlocked US refineries in the Midwest and Rockies have no other source of heavy crude that can viably displace Canadian WCS.

TMX throughput in March 2025 stood at 790,000 bopd, implying capacity utilisation of almost 90%. The Trans Mountain operator is already exploring options that could add between 200,000 and 300,000 bopd of capacity to existing pipeline capacity: drag-reducing agents, additional pump stations, even further navigation aids and dredging within Vancouver port which could increase current safety and congestion-led limits on monthly tanker loadings.

But, since it is the marginal barrel that determines the price, we would not expect the WCS discount to WTI to narrow materially with additional pipeline capacity. Indeed, it is spare capacity that ensures optionality and a higher market value for WCS. The WCS-WTI differential would widen once more were Canada’s oil operators to have no marginal access to non-US markets or the higher-paying refineries in PADD 5.

In summary, TMX has improved and stabilised Canada’s WCS crude oil benchmark pricing. Since TMX came onstream, pricing has improved by at least US$5/bbl on average and, notably, exhibits little if any of its prior volatility. However, the WCS discount to WTI is unlikely to drop below a quality/transit ‘floor’ of ca. US$10/bbl.

TMX has also enabled increased Canadian oil production and attracted new key Asian heavy oil customers such as China and India, reducing reliance on the US.

LNG Canada

Although the world’s 5th largest gas producer, Canada has long remained on the side-lines of the global LNG market. However, little more than a month ago, the LNG Canada facility in Kitimat, British Columbia (BC) shipped its first commercial LNG cargo, marking Canada’s entry into the global large-scale LNG market. LNG Canada brings Top-10 LNG export capacity of 14 million tonnes per annum (mtpa) - equivalent to 1.8 bcf/day of incremental evacuation capacity to Canada’s prolific gas-rich WCSB basins - representing ca. 10% of Canada’s overall 2024 gas production.

Global LNG Export Capacity - Canada Enters Top-10 With LNG Canada

Two further LNG export facilities, Woodfibre and Cedar, are under construction and scheduled for first commercial operations in 2027 and 2028 respectively - adding modest incremental LNG export capacity of 5.1 mtpa.

Four further LNG facility proposals, awaiting approval and final investment decision (FID), potentially add up to 30 mtpa of additional export capacity, the largest and most likely to proceed being the Phase 2 expansion of the LNG Canada facility, doubling its capacity to 28 mtpa.

At some 33 mtpa, completion of Woodfibre, Cedar and the expansion of LNG Canada would move Canada up to the Top-5 by LNG export capacity but bear in mind that Canada is entering the LNG market during the largest capacity build-out in its history!

By 2030, almost 220 mtpa of new LNG export capacity - led by the US and Qatar in a race for dominance of the global LNG market - is expected to ‘hit the market’ from projects that have secured FID and/or are under construction - adding over 50% to current Top-10 LNG export capacity.

Should global LNG demand growth fail to keep pace with this impending surge in supply, the resulting glut of natural gas will weigh heavily on benchmark prices in Europe and Asia, the latter being Canada’s obvious target LNG market.

Canada’s planned expansion of LNG export capacity may prove to be poorly timed.

But, just as WCS pricing has improved since TMX came onstream, so LNG exports are expected to ultimately raise Western Canadian gas prices which have long remained ‘in the doldrums’ - often close to zero, even negative at times.

The presumption is that any viable upstream netback via LNG exports must be better than stranded gas molecules! It’s early days but as we go to press Canada’s AECO spot price of US$0.30 per mmbtu remains subdued, well below Henry Hub at US$2.89 per mmbtu. AECO futures suggest balancing the WCSB gas market will take longer than expected. Some operators likely anticipated additional exports via LNG Canada - the result being a serious supply overhang with storage chock-full. LNG Canada has also had teething problems with one of its liquefaction trains.

As operators adjust their drilling programs and LNG Canada’s throughput increases, so AECO pricing should improve.

Canada Is Well Positioned To Supply LNG To Growing Asian LNG Markets

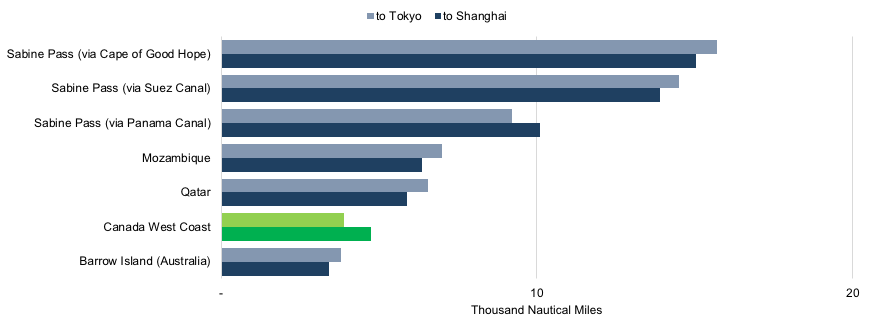

Canada Holds Distinct Shipping Transit Advantage Over US Gulf Coast & Middle East/Africa LNG

Canadian LNG shipments from British Columbia destined for Asia benefit from significantly closer proximity than most rival exporters, as well as no chokepoints such as the Panama Canal, Suez Canal or Straits of Hormuz enroute.

LNG carriers require just 10 days to travel from Canada’s west coast to Tokyo or Shanghai, half that required for anLNG shipment from the US Gulf Coast via the Panama Canal.

That 10-day shipping differential is alone worth an estimated US$1.20 - $1.25 per mmbtu in reduced transit costs, before any Panama Canal fees or congestion-related delays and costs are included.

TMX and LNG Canada Are Emblematic of Canada’s Incoherent Energy Strategy & Cumbersome Bureaucracy

The benefits, current and future, of both TMX and LNG Canada are of course welcome but have come at huge cost. Proposed in 2012, the TMX expansion project experienced numerous delays due to environmental, regulatory and legal challenges. Construction delays and increased costs caused the budget to balloon from $7.4 billion to $34 billion. Originally privately funded, TMX was ultimately acquired (i.e. rescued) in 2018 from Kinder Morgan by the Canadian government (i.e. taxpayers) which deemed completion of TMX to be ‘in the national interest’.

LNG Canada has a similarly troubled history - approved in 2018 with construction commencing a year later, the LNG facility shipped its first commercial cargo just two months ago. Beset by permit delays, build code changes and challenging site conditions, gas feed pipeline costs tripled to some C$14.5 billion, bringing the final cost of this project - LNG facility and gas pipeline - to C$40 billion - described as ‘the largest single private investment in Canadian history’!

Enbridge, a shareholder in the Woodfibre LNG plant, recently reported that construction costs have doubled to over US$10 billion, citing similar bureaucratic and operational issues.

TMX and LNG Canada serve as prime examples of Canada’s inability to nimbly and economically capitalize on its substantial energy potential. Yes, both are now onstream, but one had to rescued at huge cost to the taxpayer, the other may not deliver decent returns for shareholders.

What’s the Diagnosis?

Put simply, Canada boasts an abundance of natural resources yet much of that potential remains untapped. Canada has long lacked the political consensus and coherent regulatory framework necessary to deliver physical infrastructure where and when necessary to fully exploit its resources and maximise national wealth.

Lest we forget, Canada is far from alone in such strategic shortcomings. Based in the UK, your correspondent is all too familiar with the burden and confusion of central and local government-led bureaucracy. Vital infrastructure projects here are rarely if ever completed on time and on budget. Our latest bête noire, the HS2 high speed railway link, has seen its budget more than triple from £32 billion to well beyond £100 billion, with no certainty as to completion date!

Does Carney Possess The Remedy?

Canada’s Infrastructure Projects Have Long Been Beset By Onerous Legislation

Bill C-69: This burdensome legislation, passed in 2019, requires that the environmental impact of all large resource and infrastructure projects be assessed, including all social, health and economic effects, with particular attention to both indigenous rights and climate change targets. And even if a C-69 submission finally gains formal approval after the expensive, years-long review process, the project can still be summarily rejected by a federal veto at the very end! Hence the renaming of C-69 as the ‘No More Pipelines Act’ by the former premier of Alberta, and hence the paucity of private capital chasing such infrastructure projects, particularly after the TMX ‘bailout’ debacle.

Bill C-48: colloquially known as the ‘Tanker Ban’: Also enacted in 2019, C-48 prohibits crude oil tankers of greater than 12,500 tonnage from stopping, loading or unloading crude oil anywhere along British Columbia’s northern coast. Albeit well-intentioned, C-48 ‘killed’ Enbridge’s Northern Gateway pipeline project - which would have seen Alberta crude oil shipped to Kitimat, BC. A fresh proposal for an export pipeline and terminal at Prince Rupert would also violate C-48.

Cap-and-Trade Emission Reduction For Upstream Oil & Gas: Late last year, under the aegis of Canada’s 1999 EPA, Trudeau’s government introduced draft legislation that would cap (via a cap-and-trade system) emissions from upstream oil & gas operations and LNG facilities. Alberta and Saskatchewan have already indicated that they would appeal any enactment of such legislation - prospectively reigniting further federal-provincial conflict. It is worth noting that, given Carney’s plans for Canada to become an energy superpower, Canada would be the only major oil-exporting country with an emissions cap!

Swift, Coherent Approval Processes Are Required - Can Carney’s ‘Building Canada Act’ (Re)Build Canada?

The Carney government’s first landmark legislative bill - Bill C-5 or the Building Canada Act - is now law. In theory, this bill will streamline, accelerate and de-risk the review and approval process for projects that are deemed to be ‘in the national interest’, a tacit recognition that the current process is flawed - costly, protracted and risky.

Great news for those projects that get the go-ahead: stakeholders know from the get-go that they have federal support; under the current process, a project can take years to gain approval but still ultimately be federally vetoed.

Rather than revising or retiring hurdles such as Bill C-69, Bill C-48 or the upstream emissions cap, as many industrial leaders call for, this new law merely allows central government - in truth the federal cabinet - to decide which projects ‘make the cut’ and can side-step some if not all of these hurdles.

Not an elegant solution - since the controversial regulations remain in place - rather a pragmatic one. Amending or scrapping laws already on the statute would take years; instead, Bill C-5 provides a ‘fast-track’ for designated projects.

Anything that can accelerate construction of vital upstream, midstream and port infrastructure and drive growth of Canada’s energy sector is music to our ears, but I have a hunch that this new highly centralised legislative route will see lobbyists licking their lips and transparency potentially taking a back seat.

There will no doubt be many further obstacles to navigate - after all, the Liberals carry no sway in the key oil & gas provinces of Alberta and Saskatchewan. We anticipate intense lobbying from premiers Smith and Moe for their pet oil & gas projects. Furthermore, many indigenous groups fiercely oppose Bill C-5, believing that it will run roughshod over their treaty rights and environmental concerns. With protests already promised by some First Nations leaders, the fight over much-needed new pipelines in Canada is far from over.

The government lies three seats short of a parliamentary majority, so the minority Bloc Quebecois (BQ) party would typically hold a pivotal role in getting legislation onto the statute. Given BQ’s strong stance on renewable energy and decarbonization, such power could well derail Carney’s ambitions for Canada’s oil & gas sector. The Liberals would do well to ensure sufficient bilateral Conservative support for their legislative agenda to neuter opposition from BQ.

Are Rising GORs the ‘Canary in the Coalmine’ …

Several articles cite public-domain production data from the Permian and other shale basins that, in their authors’ opinion, indicates oil wells are irreversibly ‘gassing out’ due to the onset of ‘bubble-point’ issues, resulting in materially lower ultimate oil recovery (EUR) and thus lower asset valuations.

Shale is arguably as likely to fall foul of ‘bubble point death’ as conventional reservoirs: once reservoir pressure is drawn down below a critical level (the bubble point), gas is liberated from its prior solution in oil. Albeit raising near-term drive, associated gas ultimately ‘crowds out’ oil production due to its greater relative mobility, ‘choking off’ oil production via narrow matrix pores.

The simple remedy, in a conventional reservoir, is to reinject water, foam, CO2 or indeed gas to maintain reservoir pressure well above the ‘bubble-point’. But such reinjection does not work in shale due to its low permeability (hence the immense amount of energy, water and proppant required to frac shale).

This inability to re-pressure the shale matrix via reinjection amid evidence of growing GOR across US shale basins gives rise to the ‘bubble-point death’ argument for the inevitable, premature decline of US shale oil production.

‘Build And They Shall Come’: Canada Is Now Back On The Shopping List For US Operators & Investors

For many years, Canada has not been a high priority for international and US oil majors seeking fresh upstream investment opportunities. Quite the reverse - there has been a veritable exodus over the last decade as foreign oil companies - such as Chevron, ConocoPhillips, Devon Energy, Equinor, ExxonMobil and Shell - sold off various major Canadian upstream assets, citing high costs, the conspicuous lack of export infrastructure and growing ESG liabilities.

But Canadian upstream assets are now firmly back on the shopping list, most notably for a growing number of US private equity funds and PE-backed operators, if not the oil majors … although we have not seen much activity yet.

Why this volte-face in strategy?

As discussed in previous notes, key US shale basins such as the Permian are fast running out of prime Tier-1 acreage - some two-thirds of such acreage within the Permian’s key Midland sub-basin has already been developed. Peripheral Tier-2/Tier-3 acreage offers less favourable geology, the result being lower productivity and higher costs. Hence the rash of Permian-centric M&A deals since 2023 as operators compete for remaining prime acreage.

US-based private equity firms, such as Quantum Capital Group and Kimmeridge, are increasingly active in Canadian upstream deals, targeting both operating companies and asset packages.

Canada’s prolific Montney play is the principal target of all this fresh attention from the US … and rightly so.

The Montney’s combination of quality and quantity is currently unmatched in North America, particularly in its liquids-rich zones. The Montney is the second-largest unconventional liquids-rich gas resource in North America, holding about half of Canada’s overall gas resources. Low development costs and royalty rates and high well productivity - and valuable condensate - ensure that the Montney offers some of the best economics in North America.

Montney Outcompetes US Shale Plays On Inventory Life And Well Economics

The Permian basin may hold the largest number of undrilled Tier 1 locations, but the Montney offers a longer inventory life of high-quality locations by virtue of the slower required pace of drilling compared to the hyperactive Permian.

The Montney play possesses the deepest (i.e. longer-life) inventory of sub-US$50/bbl breakeven locations, surpassing all other unconventional basins in North America, including the Permian. Liquids-rich regions of the Montney feature some of the best economics on the continent, with breakeven oil pricing as low as $35/bbl.

But all this fresh attention on attractive Canadian upstream assets such as the Montney would not be taking place without the recent commissioning of vital export infrastructure such as LNG Canada or the TMX crude export pipeline - and the prospect for further midstream infrastructure under Canada’s new administration.

Growing global demand for LNG and Canada’s new and prospective export infrastructure offer compelling growth opportunities for the Montney, hence the renewed interest from investors and operators south of the border.

Summary

Canada has a unique ‘time window’ to significantly increase its presence in global oil & gas and other natural resource markets such as critical minerals. Geopolitical tensions are on the rise worldwide, multilateral trade agreements are under threat and energy and natural resources are being increasingly weaponized. Energy security and energy resilience are top of all nations’ agenda.

Resource-rich, politically stable and geographically well situated - with access to Atlantic, Pacific and Arctic waters - Canada can become a vital global energy and resource partner … if and only if politicians enable and encourage the requisite inward investment to accelerate all necessary infrastructure to unlock its resource wealth.

As an investor in innovative upstream and midstream technology and service companies, PillarFour Capital anticipates further profitable growth of Canada’s oil & gas sector and will, as ever, continue to seek out and invest in innovative, scalable technologies that deliver improved revenues and/or lower costs alongside lower carbon intensity for the oil and gas industry - upstream, midstream to downstream.

Download the PDF

This material is intended for information purposes only. This material is based on current public information that we consider reliable, but we do not represent it as accurate or complete, and it should not be relied upon as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so.

Estimates, opinions and recommendations expressed herein constitute judgments as of the date of this research report and are subject to change without notice. PillarFour Capital Partners Inc. does not accept any obligation to update, modify or amend its research or to otherwise notify a recipient of this research in the event that any estimates, opinions and recommendations contained herein change or subsequently become inaccurate or if this research report is subsequently withdrawn.

No part of this material or any research report may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of PillarFour Capital Partners Inc.

Website links or e-mail communications may contain viruses or other defects, and PillarFour Capital Partners Inc. does not accept liability for any such virus or defect, nor does PillarFour Capital Partners Inc. warrant that e-mail communications are virus or defect free.

This document has been approved under section 21(1) of the FMSA 2000 by PillarFour Securities LLP (“PillarFour”) for communication only to eligible counterparties and professional clients as those terms are defined by the rules of the Financial Conduct Authority. Its contents are not directed at UK retail clients. PillarFour does not provide investment services to retail clients. PillarFour publishes this document as a marketing communication and NOT Independent Research. It has not been prepared in accordance with the regulatory rules relating to independent research, nor is it subject to the prohibition on dealing ahead of the dissemination of investment research. It does not constitute a personal recommendation and does not constitute an offer or a solicitation to buy or sell any security. PillarFour consider this note to be an acceptable minor non-monetary benefit as defined by the FCA which may be received without charge.

This note has been approved by PillarFour Securities LLP (FRN 722816) which is authorised and regulated by the Financial Services Authority.